Learn how to ensure your Will includes transgender and non-binary family members in the UK. Fern Wills & LPAs explains the law, best practice, and real-life examples.

Read MoreQualified, friendly, and experienced in simplifying the process of creating Wills and Powers of Attorney to suit your specific needs at an affordable cost.

While minimising costs & taxes is important, our focus is on planning for people's families, not just their bank accounts.

We take the time to understand your requirements and work with you to create a document that aligns with them.

Remember, creating a Will and power of attorney isn't just for your benefit, it's done for the well-being of your loved ones.

Fern Wills & LPAs, because it’s for them….

Contact us

Get in touch — I’d love to help with your enquiry, no obligation.

- Fern Wills & LPAs, 7 Fern Close, Rugby, UK

- CV23 0UQ

Northamptonshire Office (for correspondence): 11 Wakefield Drive, Welford, Northants, NN6 6HN I usually meet clients by phone, video call, or in the comfort of their own home. I can also arrange meetings at a partner office if preferred. I’ll always aim to get back to you within 24 hours.

Team

Christopher Watts MSWW/ CeMap/ CertRBCB

Private Client Consultant & Will Writer

With over 24 years in financial services and 15 years specialising in Wills and estate planning, I am qualified through both the IPW and The Society of Will Writers. I also hold CeMAP (Distinction) and have completed additional studies in dementia care, helping me support families with empathy as well as technical expertise. Having experienced personal loss myself, I know how important it is to plan with clarity and compassion. My aim is to make the process simple, jargon-free, and reassuring, so clients feel confident at every stage. As a father of five in a blended family, I understand the real-life challenges of family dynamics and the importance of protecting those you love for the future.

Back-Office Legal Team

Legal & Technical team

WillPack bring over 30 years of experience in Wills, Lasting Powers of Attorney, and estate planning, and are a founding member of The Society of Will Writers. They provide technical support to professionals across the UK, ensuring that documents meet the highest legal standards. At Fern Wills & LPAs, all documents are prepared and tailored by me personally. WillPack act as my behind-the-scenes legal partner, available if I need an additional technical check, or to provide extra resilience in busy periods. This means my clients always benefit from both personal attention and the assurance of an experienced safety net. I also draw on WillPack’s regular industry insights to keep my advice current and practical. Their partnership strengthens the depth and reliability of the service I provide, while ensuring that every client benefits from up-to-date expertise and proven legal quality.

Trusted Advisors

Specialist Network

Alongside my own expertise, I work closely with a trusted network of professionals who can provide specialist advice when required. This includes independent financial advisers, accountants, care specialists, property professionals, and other advisers whose knowledge complements the estate planning work I carry out. I remain the single point of contact for my clients, coordinating any input from these trusted advisors where it benefits the client. This ensures advice remains joined-up, jargon-free, and tailored to each family’s needs. Clients never have to manage multiple professionals — I handle the process, while drawing on the right expertise at the right time. This collaborative approach means clients receive not only personal, one-to-one support from me, but also the reassurance that additional knowledge is available whenever their circumstances call for it. Working in this way strengthens my service and ensures that every client receives clear, practical, and fully-rounded guidance.

Services & Fees

We listen, explain the options, and let you choose. We offer transparent, fixed fees with a written quote. Our fees reflect the standard of service and expertise provided — designed to deliver value and peace of mind.

A professionally drafted Will that gives clarity, protection, and peace of mind. Fixed-fee pricing includes consultations, full copies, and lifetime support for future updates.

Read MoreComprehensive Will Trust packages that protect homes, families, and beneficiaries. Choose from Right to Occupy, Life Interest, Discretionary, or Flexible Life Interest Trusts — all fully drafted within your Will.

Read MoreCreate your Property & Financial Affairs and Health & Welfare LPAs with full professional drafting, registration, and signing guidance.

Read MoreArrange a personal home, online, office, or family meeting to discuss your needs, wishes, and options in a relaxed, no-obligation conversation.

Read MoreKeep your Wills and LPAs safe, insured, and instantly accessible with Fern Wills & LPAs’ professional document storage service.

Read MoreUpgrade your Will, Trust or LPA with convenience-driven extras: printed originals, guided calls, priority scheduling and support for you and your family.

Read MoreA combined MOT for your Will and LPAs — one simple £45 review to make sure your documents stay valid, compliant, and up to date.

Read MoreClear, fixed structure fee help, with the legal and financial process. Delivered by our trusted probate specialist. Free 20-minute consultation and written scope before work starts.

Read MoreProtect each owner’s share with a fixed-fee Declaration of Trust. Clear, transparent, and professionally managed through Fern Wills & LPAs and our trusted specialists.

Read MoreA legally binding Advance Decision (“Living Will”) lets you refuse specific medical treatments in advance and works alongside your Health & Welfare LPA to ensure your wishes are followed.

Read MoreReviews

WE AIM TO SURPASS YOUR EXPECTATIONS. OFFERING EXCEPTIONAL VALUE, GUIDANCE, AND SERVICE.

Please CLICK to leave a reviewI chose Chris to apply for LPAs. He was informative, and I was soon confident I made the right choice. I was particularly happy to have home visits as I don't like doing business on the phone. He was very easy to talk to and willing to discuss and explain things. Chris has planned a process in which his fee covers everything, even stationary and postage. I would have no hesitation in recommending Chris.

Full Review"I needed a Power of Attorney for my foreign property, but the solicitor's quote of £800 was too expensive. I got all the documents for myself, mother, & brother at a fair price. He is an honest person, and I recommend him to my family.

"I wrote my Will three times. After my wife died, my brother and I reconciled briefly, but we fell out again. I don't have much of value, but my medals and records are important. I gave Chris something when I updated my Will for the third time, but it probably didn't even cover the cost of his petrol. Thanks."

"We thought a basic Will was enough but our daughter's specific needs exceeded our budget. Chris added the Trust for free instead of providing a Will that wouldn't match our needs. We're grateful and happy to recommend him."

I have divorced my husband and definitely don't want him to have custody of our children or any more of our money. Chris explained a few strategies that would help to ensure that my children are protected.

"My husband needed an operation but was nervous to discuss it. I booked the appointment and Chris made us feel at ease. He wrote and signed the Will within 48 hours."

"I got an LPA for my daughter to help me on bad days. We needed it urgently, so we got a General one for now. He called my son to explain. My daughter is relieved."

I bought a house after a divorce. I needed a Will as my health wasn't great, and there were now a few people who I definitely did not want to inherit. I did not know anyone in the area, so he organised a Witness for me. Great Guy!

I've been with my partner for 12 years, have three kids, and own a house in his name. I contribute to the mortgage and bills, but we found out that I would inherit nothing if something happened to him because we're not married. Also, he has no legal rights over the kids as his name isn't on the birth certificates. We sorted these issues out, but it was a wake-up call.

"As a teen, I had a child but lost contact. I need to do right by them. I was helped to leave an inheritance confidentially."

Fern Wills & LPAs made setting up my will and trust straightforward and affordable. Their transparent pricing was refreshing!

Chris is very easy to talk too and listens. Able to explain technical jargon in a way we could understand. Chris responded very quickly to questions we raised. Involving my family in discussions can be distressing. Chris understands and is able to put people at ease. Chris is passionate about what he does and this is evident. We would have no hesitation in recommending him.

Full reviewGetting my mum's LPAs in place was a worry/stress and seemed extremely complicated. But thanks to Chris it was made extremely easy. Chris explained everything to all involved in a way we could all understand. He visited my mum's home and made us all feel very relaxed. For us personally it was all done effortlessly. It didn't feel uncomfortable, we all got on very well and had a laugh (my mum's a bit of a character). I can't thank Chris enough for making the whole experience smooth, effortless and more easy for us to understand. I would and will highly recommend him if you find the the thought of reading all the paperwork a stress and overwhelming. Thank you Chris from all involved 😀😍. If you are reading this and need help please give him a call.

Outstanding, Informative and Personal service. Chris prioritised our understanding of the services we had requested, breaking down processes so that they were understandable, clear with timelines and made our task of completing official paperwork easy and accurate. Chris takes genuine pride serving his client. I have no hesitation in suggesting you look no further, Fern Wills & LPAs provides the 5* services you are looking for.

Professional service from Chris for my elderly uncle’s LPA needs. We had a home visit and lots of communication via phone calls and email. Everything was explained to my relative and we were both happy with the outcome.

I had the pleasure of working with Chris from Fern Wills on an urgent B2B project. Chris demonstrated the ability to be flexible working outside of business hours. He was knowledgeable, professional and personable throughout our interactions. I would highly recommend Chris and work with him again at any given opportunity. A breath of fresh air!

Full ReviewWould 100% recommend Chris if you are looking to get your will sorted. We’d put off sorting our will time and again but Chris was able to explain all the legal jargon in simple terms and was very patient with us whilst simultaneously encouraging us to finally get it done! There is no one-size-fits-all approach here, Chris listened to our requirements and advised accordingly, providing options and recommendations at every step. Nothing was too much trouble and he was always available to answer any queries we had. His prices are very fair and he is upfront with all the costs, there were no hidden charges!

Full ReviewI would highly recommend Fern Wills to help you with your will and power off attorney. Chris is professional, very understanding, he explains everything step by step. Such a pleasure to talk to. Thank you Chris.

Full ReviewChris made the process of setting up multiple family LPAs and Wills easy to navigate with great patience, flexibility, multiple visits and online meetings. I particularly appreciated having an informal open conversation at the start of the process without any commitments, where as most other suppliers wanted forms filling in which didn't capture the complexities of our requirements before even talking to us. I feel Chris's approach allowed the subtleties of our personal circumstances to be explored opened up options we were not even aware of to be considered. It really helped to be listened to and build a mutual understanding of what is possible and what we wanted to do Chris was reassuring during the whole process and checked in on our progress checking and validating documents up to and including all the online One Govt access was working correctly.

WE AIM TO SURPASS YOUR EXPECTATIONS. OFFERING EXCEPTIONAL VALUE, GUIDANCE, AND SERVICE.

Please CLICK to leave a reviewArticles

Wills Articles

Blended families include couples who have children from previous relationships. As joyful and fulfilling as they can be, they also come with unique estate planning challenges — especially when it comes to ensuring everyone is treated fairly.

Read MoreDiscover how to exclude someone from your will while protecting your wishes. This article explains real-life cases, success stories, and the Inheritance Act 1975, with practical tips to avoid disputes and ensure your estate passes as intended.

Read MoreA third of marriages in England and Wales involve someone who’s been married before—often with children from previous relationships. Blended families bring complex financial dynamics, so how do you provide for your new spouse while ensuring all your children inherit fairly? Here's how to balance love, legacy, and lifelong commitments.

Read MoreChoosing music for a goodbye is a personal reflection of our identities, whether it's Sinatra, Beyoncé, or "Always Look on the Bright Side of Life." A Lloyds Bank study shows 80% of adults have selected their final songs, but only 59% have written a will, prioritizing funeral playlists over financial planning.

Read MoreA codicil is a legal document used to make amendments to an existing will without the need to draft a completely new will. Codicils can be used to add, alter, or revoke specific provisions in a will, and there is no statutory limit to the number of codicils a testator may execute. However, using codicils requires careful consideration due to the risks and complexities involved.

Read MoreLet's delve into the intriguing stories of celebrities who, despite their immense wealth, either passed away without a will or left behind ambiguous and contentious legal documents. Their legacies often sparked disputes and raised questions about how their fortunes would be handled after their deaths.

Read MoreMost people accumulate a great deal of ‘stuff’ throughout their lives. Some items are valuable in real monetary terms, while others hold sentimental value. Much of this personal property falls under the definition of ‘personal chattels’.

Read MoreInheritance tax can cost loved ones £100,000s when you die, with it generating £7 billion for HM Revenue & Customs in one recent tax year alone. But in reality the vast majority of people (around 96%) don't have to pay a penny, while the few who do can legally avoid huge swathes of it. This guide runs through five inheritance tax need-to-knows.

Read More2024 has been a pivotal year in the landscape of wills and estate planning. We can reflect on the changes made throughout the year and there have been a number of key developments. This article delves into these developments and their implications.

Read MoreA survivorship clause is exactly what it sounds like: a clause in a will that makes a gift to a beneficiary conditional upon them surviving the testator by a set period. While these clauses are commonly used in modern wills, it’s clear that many people don’t appreciate the adverse effects they can have on an estate.

Read MoreThere are two ways that a person can make a claim against a deceased’s estate, the first being a claim under the Inheritance Provision for Family and Dependants (IPFD) Act 1975. The second is on grounds of validity.

Read MoreTrusts Articles

We should always consider Pets (the furry, scaly, feathered type). You may be pleased to know you can make provisions for them in your Will. Pets can be included in your will through an animal-purpose trust, which ensures their care and upkeep.

Read MoreBusiness property relief can significantly reduce or eliminate inheritance tax on business assets. Many UK businesses could be eligible for up to 100% relief. However, this complex area of estate planning often necessitates additional professional advice.

Read MoreSHOULD YOU GIVE YOUR HOUSE TO YOUR CHILDREN NOW? USUALLY NO! Of course, it depends on the reasons and individual circumstances. Clients often tell us that either an advert on Facebook, usually with brightly coloured writing, or “Dave” down the pub said it is the best thing to do to avoid “well basically” everything from probate to care fees.

Read MoreAsset Protection Trusts (APTs) are a valid and effective tool for estate planners when used in the right circumstances. These trusts often come with higher fees, making them an attractive option for some to pursue higher profits without fully appreciating the risks and considerations involved in advising clients. A lack of understanding can lead to FALSE OR MISLEADING CLAIMS.

Read MoreExplains what a Will Trust is, the types available, and how each protects family, property, and inheritance.

Read MoreOffers & Charity

Professional Partners

We work with other specialists to ensure the best service for you for many years to come. We are pleased to make introductions to our Trusted Advisors & receive introductions or collaborate with yours.

Learn how Fern Wills & LPAs collaborates with other professionals through its Professional Partner Programme — a framework for ethical, client-first introductions and long-term partnership.

Read MoreImplementing the FCA's consumer duty principles holds the trusted adviser industry accountable for delivering good consumer outcomes. This includes estate planning as part of wealth preservation, which should be conducted at annual reviews or when relevant to clients' needs.

Read MoreWe understand the importance of comprehensive estate planning. We work closely with financial advisors to ensure our recommended plans align with your needs and preferences.

Read MoreHolistic property solutions, where mortgage advisors, estate agents, and estate planners work together to find the best solutions for clients.

Read MoreAn accountant's knowledge of a client's personal and business affairs, as well as inheritance and capital gains tax, makes them well-placed to help clients decide what to put into a Will or Trust.

Read MoreAdvocacy involves providing support and guidance to individuals to help them express their views, make informed choices, and access services that meet their needs. Advocates work alongside you to ensure your voice is heard and your rights are upheld, empowering you to confidently navigate life's challenges.

Read MoreWe introduce clients to trusted notaries and apostille providers for ID documents, overseas property, bank loans, business paperwork and more, with no obligation to take other services.

Read MoreCare decisions are never just about today. They affect a person’s money, home and family for years to come. Fern Wills & LPAs works alongside independent care advisors, home care providers and independent capacity assessors so that good care is backed up by clear, practical legal planning. Clients get joined-up support. Professionals know their advice is reinforced, not undermined. Families get fewer shocks and fewer crises.

Read MoreInsurance serves to restore your financial standing to what it was before an unfortunate event occurred. It offers peace of mind and protection against financial loss. Additionally, it plays a vital role in estate planning; after all, you cannot leave behind something that you have already lost.

Read MoreIn today’s fast-paced business environment, HR consultants play a crucial role in ensuring employees' well-being and legal compliance. One often overlooked aspect of this is the referral to professional Will writers. Here’s a look at why HR consultants might make these referrals and how they benefit employees and employers.

Read MoreCelebrants and Will Writers:- These two professionals—each with distinct expertise—can collaborate to create a more seamless, compassionate experience for clients and their families. They can combine their skills to offer a complete service that provides comfort, clarity, and peace of mind.

Read MoreFern Wills & LPAs work well with other Will Writers and Estate Planners. As members of the SWW, we meet up, share best practices, and give each other help advice.

Read MoreCompliance

ensuring your rights, security and peace of mind

To ensure the highest professional and ethical standards, the following standard terms of business apply to all instructions accepted by Fern Wills & LPAs.

Read MoreFor your information security, we verify every client's identity. Please provide an original passport or UK photo driving licence to copy and keep with your records. See the attached list of alternatives.

Read MoreThese notes are intended to assist practitioners (Will & Trusts Writers), settlors (Clients providing the trust), and testators (Clients providing the Will) in the use of the STEP Standard Provisions.

Read MoreThe privacy policy outlines how Fern Wills & LPAs may collect and use your data.

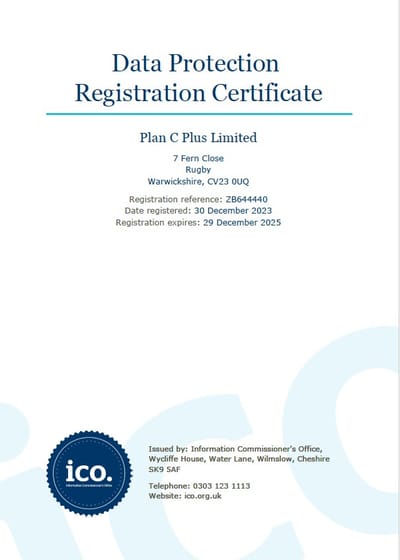

Read MoreFully Data Protection registered and Compliant

Read MoreThis guide covers the information that must be read by or to every Donor and Attorney of a Lasting Power Of Attorney.

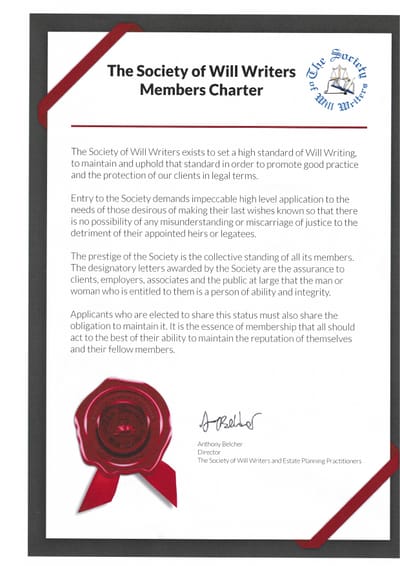

Read MoreThe Society of Will Writers exists to set a high standard of Will Writing, to maintain and uphold that standard in order to promote good practice and the protection of our clients in legal terms. Below, you will find attached the Society Of Will Writers members and Clients Charters.

Read MoreWe commit to offering customers the highest possible service standards and are pleased to support the Society of Will Writers ‘TCF principles.

Read More