How is your Property Held?

Severing a Joint Tenancy

Couples usually buy a property together as joint tenants, which means they both own the entire property, and the ownership automatically transfers to the surviving owner in case of one owner's death. If you want to gift your share of the home in your Will, you must change the ownership to tenants in common or be the sole owner. Note that if there is a life interest trust in the Will, the title must be severed for the share of the property to enter the trust. Let's first look at the difference between holding the home as joint tenants and tenants in common.

How is your property held?

Sole Owner (100% One person)

If only one person owns a home and it is not registered with the Land Registry as either Joint Tenants (100%/100%) or tenants in Common (50%/ 50%). It is registered as a Sole owner.

Joint Tenancy (100% each)

Joint tenancy means owning a property equally with another person. When one owner dies, the other automatically becomes the sole owner. You cannot leave your share to someone else in your Will.

Tenants in Common (50%-50%) or (70%/ 30% etc)

When owning a property as tenants in common, each owner has a divided share, which can be equal or unequal. Trusts can be used to protect individual shares. To check ownership, download the title register from the land registry website. To change from joint tenants to tenants in common, complete a notice of severance and an SEV form, then send them to the land registry.

Do I have to instruct a conveyancer to carry out the severance?

No. Fern Wills Can do this for you.

Does the severance have to be mutually agreed upon by the homeowners?

No, you can serve a unilateral notice of severance on your partner to sever a jointly owned home due to a dispute. This is common when couples are going through a divorce. A Mutual Severance is when all property proprietors agree to sever the tenancy. A Unilateral Severance is required if one or more proprietors are unwilling or unable to sever the tenancy. In such cases, we would need to serve notice on the other proprietor(s) to inform them of the severance.

What is the severance of a joint tenancy?

Severance of a joint tenancy is a legal process that changes the legal ownership of property from joint tenants to tenants in common. Usually, both parties agree to sever the joint tenancy. However, both parties don't need to decide. One party can serve notice on the other, requiring them to sever the joint tenancy, regardless of their preference.

How can I tell if my tenancy is severed?

Fern Wills can search for you and advise on the Title Register Document.

Severed tenancy (Tenants In Common 50/50, etc.) shows as:

"No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court"

This restriction alerts a Solicitor or Conveyancer to the fact that the owners are tenants in common and one cannot sell the property alone.

Non-Severed tenancy (Joint Beneficial Tenants 100/100) shows as:

"RESTRICTION: No disposition of the registered estate by the proprietor of the registered estate is to be registered without a certificate signed by a conveyancer that the conveyancer is satisfied that the person who executed the document submitted for registration as disponor is the same person as the proprietor. a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court"

Why would you sever a joint tenancy?

Severing a joint tenancy converts the ownership into a tenancy in common. There are three main reasons for doing this:

- To end the automatic right of survivorship. Consider severing a joint tenancy and creating a Will if planning your estate. This ensures that your beneficiaries receive their share of the property without being dependent on your partner. Opting for a tenancy in common gives you more control over what happens to your property after your death, allowing you to decide who gets what.

- Property income. If you own a rental or income-generating property with someone else, you can change how you split the income by severing the joint tenancy. This means you can receive income in unequal shares, for example, 60-40 or 70-30, not only the traditional 50/50. By doing this, you can create a tenancy in common, which is a more tax-efficient way for co-owners to share rental income. For example, the lower earner could take 70% of the rent to take advantage of potentially lower income tax brackets.

- Separation and divorce. In divorce proceedings, joint tenancy is often severed to prevent an ex-spouse from automatically inheriting the property. It also specifies ownership interest, resolving any future disputes regarding the sale of the property

The following section is technical and not needed to understand Severance of Tenancy.

How to read a title register

Your property

The Land Registry assigns a unique reference number known as a title number to each property. It also prepares a register and, in most cases, a title plan. The register contains important information about the property, such as the names of the legal owners and any mortgages, rights of way, or other legal matters that may affect it. Additionally, it includes a description of the property—usually the postal address—and indicates whether it is held for a specific period of time under a lease (leasehold) or owned outright (freehold). Typically, you need to read the title register and the plan together, but we will focus solely on the register for our topic.

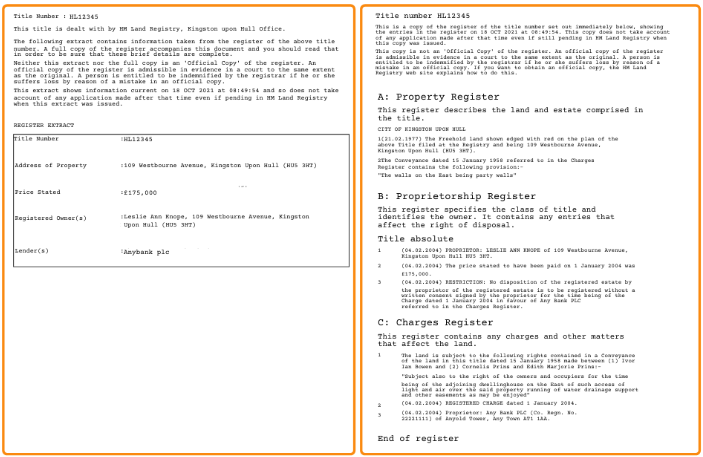

See the below example of a title register:

Three parts

Three parts

Most title registers are split into 3 parts:

- A - property

- B - proprietorship

- C - charges

This article is just concerned with restrictions, as found in part B.

Restrictions

Restrictions stop HM Land Registry from completing the registration of certain transactions, such as transfers, leases or mortgages, unless the conditions specified in the restriction are met. Their purpose is usually to make sure that specific legal requirements are complied with. For instance, a restriction might require a certificate of compliance with the terms of a previous transfer or other document or the consent of someone other than the registered proprietor.

Common restrictions

These are some common restrictions you might see in your register:

(13.02.2019) Restriction: No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court.

This is the most common restriction, entered when the owners are trustees. It limits what one proprietor can do on their own. This shows severed tenancy (Tenants In Common)

(20.02.2002) Restriction: No disposition of the registered estate by the proprietor of the registered estate is to be registered without a certificate signed by a conveyancer that that conveyancer is satisfied that the person who executed the document submitted for registration as disponor is the same person as the proprietor.

This restriction helps to guard against fraud. Disponor is a legal term for a person who transfers or conveys property to another. It is also known as Alienor.

Example: Andy is the disponor of the house he sold to Katy. He transferred the ownership of the property to her.

Explanation: The example illustrates the definition of disponor by showing how Andy, as the disponor, transferred the ownership of the house to Katy. This means that Andy conveyed the property to Katy, making her the house's new owner.

(17.10.2018) Restriction: No disposition of the registered estate by the proprietor of the registered estate is to be registered without a certificate signed by A Named Company PLC that the provisions of clause 22 of the Fourth Schedule of the registered Lease have been complied with.

You’ll often see this where a management company is appointed to provide certain shared services.

(05.11.2012) Restriction: No Transfer of the registered estate by the proprietor of the registered estate is to be registered without written consent signed by AN Other of 14 Any Road, Anytown AN1 1 AA or their conveyancer.

To register a transfer, you’ll need the written consent of the named person or company. You do not need consent to register for a lease or mortgage.

Most content is available under the Open Government Licence v3.0, except where otherwise stated.