Common law marriage "myth"

If you and your partner are unmarried or have not entered a civil partnership, then the intestacy rules (not having a Will) are not your friend. Intestacy doesn’t recognise these relationships, so your partner will receive no benefit from your estate. The concept of ‘common law marriage’ is only a myth and has no legal basis. In the eyes of the law, you could have met online yesterday.

Living together as a couple for a certain period does not grant you the legal status of 'common law spouses'. If you are not married, you have no right to inherit from your partner's estate if they die without leaving a will.

To avoid confusion, a cohabiting couple is two people who opt to live together outside of marriage or a civil partnership yet are in a relationship.

Rights under law

The terms of inheritance law are clear. If you live with your partner but are not married or in a civil partnership, you have no entitlement to your partner's property or assets on death. The situation is no different, even if you have children together. In essence, the law favours married couples or civil partnerships. If unmarried, the surviving partner receives nothing.

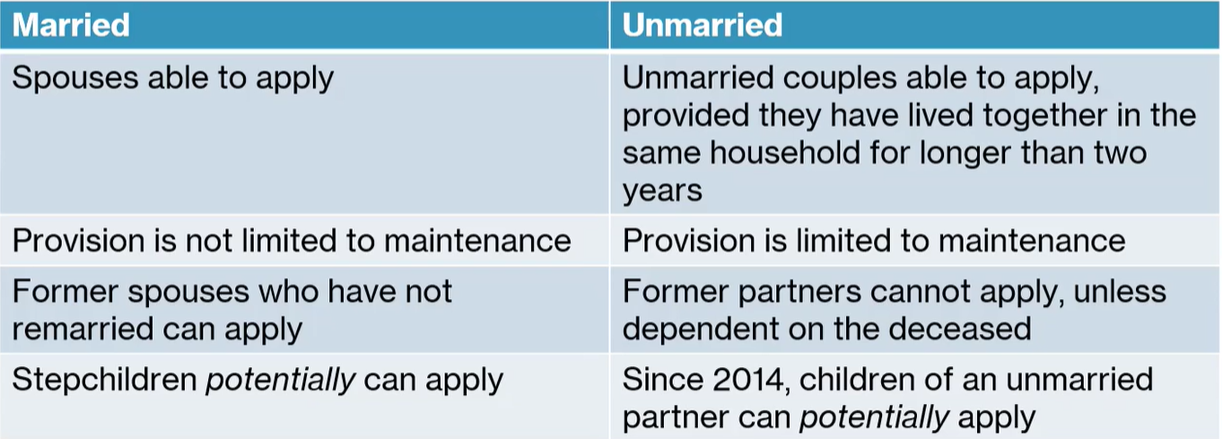

If an unmarried partner's significant other dies without a will, they may be able to apply for provision under the Inheritance (Provision for Family and Dependants) Act 1975. A cohabiting partner can apply for provision as long as they have lived as if they were spouses in the same household as the deceased person for two years (recently) before their death.

Former partners cannot apply under the 1975 Act like former spouses can. The only potential would be under S1(1)(e) as a dependant of the deceased. This also applies to any children if they were treated by the deceased as a child of the family. This was for step-children only up until 2014.

Even if the court does make an award for a married survivor, the courts may decide to make an award equivalent to what they would have been if they were separated by divorce rather than death.

For unmarried couples, it is likely to be focused solely on maintenance.

Overview of the 1975 act.

If you are cohabiting with your partner and wish to make sure they inherit from your estate, you should make a will. If you jointly own a property with a partner (and this is registered at the Land Registry), you are entitled to your share of that property.

Funerals

Equally distressing can be when, without a Will, the unmarried partner has no rights to decide funeral arrangements or even what happens to the body or ashes. If no close family members are unavailable or do not wish to be involved then the Local Authority in which they died (not lived), has the responsibility for sorting out the funeral arrangements and the disposal of the body (s.46 of the public health (Control of disease) Act 1984).

Parental Responsibility (PR) & Guardianship.

PR is defined as "all the rights, duties, and authority which, by law, a parent of a child has in relation to the child and their property" (S31 Children Act 1989). This effectively grants the power to make decisions concerning a child.

Only individuals with PR can appoint guardians in a will (see the Guardianship article for further information).

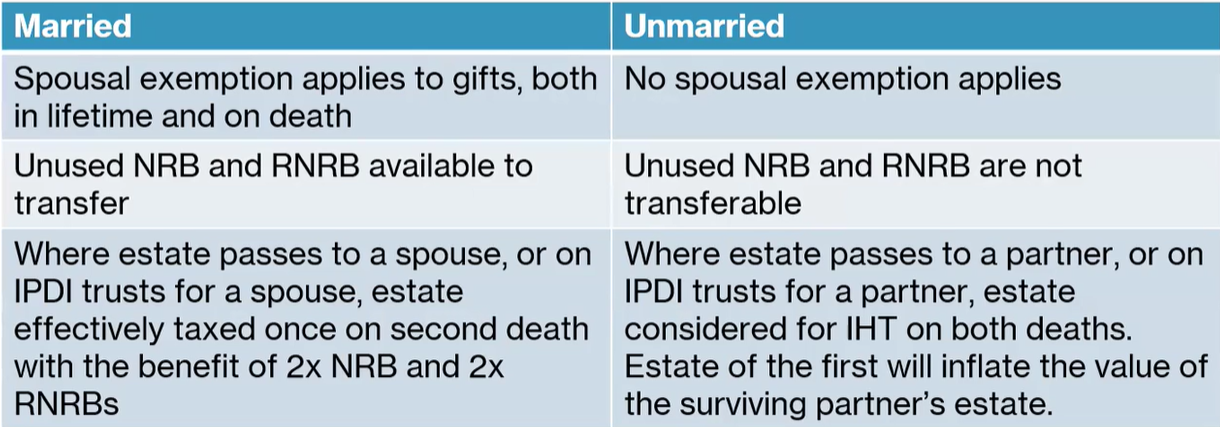

TAX

Married couples or those in a civil partnership have an unlimited tax allowance between themselves. All others do not. Therefore, any amount exceeding the Inheritance tax (IHT) Nil-rate band (NRB) allowance, currently £325k, will be taxed at the prevailing rate of 40%.

Summary of differences in taxation.

One effective way to reduce this 40% liability is to use a trust. Various types of trusts are available, but those with a discretionary trust (DT) element are typically the most suitable. While a separate article is dedicated to discretionary trusts, here is a brief summary.

Put the Equivalent NRB into a trust on 1st death = £325k. This is now IHT-exempt.

You can give your Trust ("partner") £325,000 without incurring Inheritance Tax, which can save you up to £130,000.

For some trusts, there are setup, entry, anniversary, income, and exit fees and taxes, though these are usually below the amount you save.

Notes on RNRB for stepchildren.

For married couples, stepchildren are considered descendants and qualify for RNRB, whereas children of unmarried partners are not.

Trust Planning for unmarried couples.

There is no perfect solution for trusts for unmarried couples. Life interest and flexible life interest trusts are less advantageous for unmarried couples because they are taxed upon both the first and second death, rather than only on the second death like married couples. They still have their uses though often there is a better solution.

Discretionary Trusts are often more advantageous.

A Property Protection Trust and other Discretionary Trusts can enable a partner to reside in the property rent-free. After the second partner's death, the property can then be distributed to their children. The Trust is treated as having inherited the property upon the first partner's death, which helps prevent an increase in the surviving partner's estate value. It makes better use of both Nil rate Band allowances. Exit and anniversary charges are complex, though typically, the maximum charge that will apply will be 5.85% exit charges and 6% anniversary charges every 10 years on everything above the NRB (at the time of charge).

Exceptions to common law status

It is said that there is an exception for every rule, and sometimes these make a bad situation worse.

Scenario 1

In Banfield v Campbell [2018]. Mrs Campbell left £5000 to her "friend", Mr Banfield and the family home and everything else to her son James on his 25th birthday. She did not, however, update her Will for several years.

On a flight back from the Canary Islands, Mrs Campbell died. James and other Witnesses claimed Mr Banfield was like a lodger as he slept in a separate room, though he did not pay rent because Mrs Campbell did not wish to be alone.

Not satisfied with the £5000, Mr Banfield challenged the Will, stating that he was a financially dependent cohabitant and could not afford his own home. The Judge ordered that Mr Banfield receive a maintenance allowance. Mr Banfield claimed this was not enough. The result was that the judge ordered the home to be sold, and Mr Banfield was given a life interest over half the proceeds. Mr Banfield applied for more, but the judge ordered the other half to go to the son since he was the intended beneficiary of the will.

Scenario 2

If a property owner enters care, the home will be disregarded for the means test if an unmarried partner or another relative lives there as their sole or main residence. However, councils have discretionary powers to consider "all relevant factors." Therefore, if it is determined that the residency is primarily to preserve a family inheritance or to avoid the sale of the property, they may choose not to disregard it.

These cases highlight the importance of keeping your planning current and regularly reviewing Wills as relationships evolve and change.

Acknowledgement to Siobhan Rattigan, Senior Lecturer for the College of Will Writing.

Contact us now for a free, no-obligation conversation if anything in this article affects you or your children.