20 considerations for your assets.

Planning for your estate may not be the most uplifting topic, but it holds significant importance in ensuring that your final wishes are honoured and your loved ones are provided for. Here, you can find a list of 20 potential scenarios outlining what could happen to your assets after your passing.

If you have a Will. Your executor will administer your estate after you pass away. This includes filing your income tax, paying off your debts, and ensuring your assets are distributed according to your wishes.

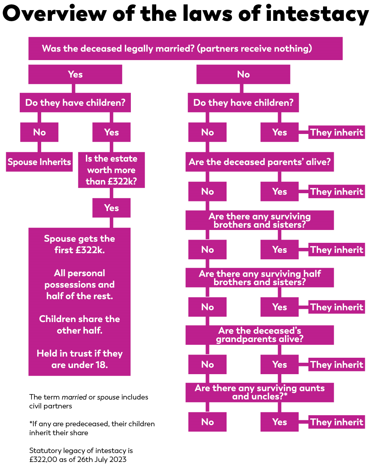

If you do not have a will. If you pass away without a will, the government will determine the distribution of your assets according to the intestacy rules. Don't assume that everything will go to the surviving partner, and you will still likely need a grant of letters of administration. Typically, your assets will be distributed among your surviving heirs, including your spouse, children, parents, and siblings.

If your Will is contested. The Will can be contested for many reasons.

The Inheritance (Provision for Family and Dependants) Act 1975 enables the court to adjust the distribution of a deceased individual's estate to ensure financial provision for their spouse, former spouse, child, child of the family, or dependant. This is designed to safeguard those who relied on the deceased person for financial support.

Deprivation of assets refers to intentionally diminishing one’s assets, such as money, property, or income, in order to avoid having them included in the financial assessment for care home fees.

If your Will needs changing. Typically, your beneficiaries can change your will after you die within two years, as long as they are all in agreement. It may seem odd, but there can be many reasons for this—whether it’s to ease the tax burden or reward a beneficiary who cared for you more than others.

If you have student debt. If an individual with a student loan passes away in the UK, the Student Loans Company (SLC) will cancel the student loan. To start this process, it is necessary to inform the SLC about the individual's passing and provide evidence, such as the original death certificate, along with the person’s Customer Reference Number. The student debt will be cleared in the event of the debtor's death, regardless of the remaining amount owed.

If you have an income. After you pass away, your executor will need to file your final income tax return. This includes reporting income earned in your final year, as well as any interest earned on your assets before they are distributed to your heirs and any capital gains earned on assets, such as stocks and bonds, that are sold after your death.

If you have a debt. If you have any remaining debts when you pass away, they must be settled before your beneficiaries can receive their inheritance. Debts can include loans or even regular bills like utility expenses. If your estate doesn't have enough money to cover your debts, your assets might be sold to pay them off. Normally, your debts cannot be inherited by other people, but there are some exceptions, like joint or co-signed debts.

If you have Property. One challenge with property is that, unlike liquid assets, it’s hard to divide up a house among multiple heirs unless you specify that it be sold and the proceeds distributed according to your wishes. If you want one child, for instance, to live in your home and buy out your other children, you will need to specify this in great detail in your will to avoid any disputes.

If you have a mortgage. If you were to pass away before paying off your mortgage in full, the person who inherits the house can decide to either take over the remaining mortgage to keep the house or sell the house to pay off the debt. If you have a co-owner of the house, such as a spouse, they are responsible for making the mortgage payments.

If you have equity release. some people take out equity release to bolster their retirement savings. This debt must be paid by whoever inherits the property. Depending on the size of the equity release, there may be little equity left. Each scheme will have its own contract that needs to be fulfilled before the property is released.

If you have a car loan. If you still have a loan on a vehicle when you die, it will be paid off by your estate. If there’s not enough money left in your estate and you were the sole borrower, then the vehicle may be repossessed, unless the inheritor wants to keep the car and continue paying off the loan.

If you have Inheritance Tax to pay. Inheritance tax is 40% of everything over the allowance. 36% if 10% of the estate was given to charity. This must be calculated and paid to HMRC.

If you have a private pension. The amount of pension benefits for surviving spouses depends on factors such as the age when the person died (under or over 75yrs). The specific pension plan. Some beneficiaries may receive monthly benefits or a lump sum after their spouse passes away. Whether or not they have to pay taxes on these benefits depends on their individual situation.

If you have life insurance or assurance. Typically, life insurance pay-outs are protected from creditors and are rarely taxed. This provides a good option for ensuring that you will have something left to leave to your loved ones.

If you were charitable. There are many different options when it comes to leaving a gift to charity, but the important thing is to include detailed information about your charitable wishes in your will so that there is no ambiguity. There are Inheritance tax benefits of leaving 10% of your estate in a Will.

If you want to protect your gifts and beneficiaries. If you want your children to inherit everything, but are concerned about their spouses (your sons- or daughters-in-law), you might be worried about what would happen if their marriage ends in divorce or if their spouse is bad with money. One possible solution is to set up a trust so that the assets are not combined with marital assets and, thus, not subject to division in the event of a divorce.

If you have a secret. Do you have a mistress or a love child whom you'd like to secretly provide for after you're gone? You can set up a secret trust, where you leave money to a person in your will with prearranged instructions that they will confidentially give the money to someone else.

If you have pets. While pets are considered property, you cannot designate them as beneficiaries. However, you can establish a pet trust to ensure they receive proper care after your passing. we simply want to ensure our beloved pets are looked after when we're no longer around.

If you have a business. A business can be one of the most complex assets to plan for as it is not easily converted to cash and may require continuous management. The simplest option is to sell the business and divide the proceeds. However, if you have built the business from the ground up and want to ensure its survival after your passing, passing it on to a family member is one option. This can be complicated due to potential sibling conflicts, buyout issues, and potential mismanagement. Therefore, the best option may be to create a solid succession plan.

If you have land. Some people have a deep love for the land they live on and the animals that call it home. If you are concerned about what will happen to your property after you pass away, you can ensure its perpetual protection and use as a wildlife sanctuary by donating it to a charity dedicated to that purpose.