Wills

At Fern Wills & LPAs, we recognise the importance of having your own will. I say your own will because, without your own, it's "like" the laws of intestacy make one for you, and no conversation or informal arrangement can override these.

I help you to help your family.

🌿I provide expert, friendly guidance with will writing and estate planning. I help clients to help their families by:

🌿Gifting Specific items: You would be amazed by what families treasure most, such as wedding rings, photographs or Grandad's antique shaving kit. Tailoring your will is a genuine gift that may mean more than the money, and being clear can certainly avoid any potential disputes.

🌿Distributing Property: A will combined with a trust clarifies who lives in, inherits, and profits from your property.

🌿Potentially reducing Inheritance Tax: Crafting a Will and trust with your beneficiaries first in mind can help minimise tax liabilities.

🌿Ensuring your partner’s financial security. Whether married, in a civil partnership, or have a long-term partner, providing for their future gives lifelong peace of mind.

🌿Ensuring Children's or Dependents' stability: Arrangements for their care and financial security are vital.

🌿Clarifying who does not inherit: You may want to ensure that someone may not inherit equally or at all. They may be financially secure already, may not have contacted you in decades, or a difficult separation means they have taken enough from you already. The will specifies who inherits. Together with a professionally drafted memorandum of wishes, it provides additional preferences and explanations.

🌿Helping others: A token or generous gift to a friend, distant relative, colleague, club, society or charity will leave an appreciated, lasting legacy.

Common misconceptions about Wills.

“I’m married, so if anything should happen to me, my partner will inherit all my possessions automatically.”

Reality:

Many people think that if you’re married or in a civil partnership, your partner will automatically inherit everything when you pass away. However, this is not the case. The law has specific rules for asset distribution without a will. Consequently, your spouse might not inherit automatically, and improperly structured wills could result in your children losing some of their inheritance. Equally, the rules make no provision for a partner if you are not married or in a civil partnership, so the only way you can ensure you look after each other is by way of a Will.

“Creating a Will is complicated and expensive.”

Reality:

The process is straightforward with professional assistance. The cost of not having a Will can far outweigh the investment in creating one. By drafting a Will and having a grant of probate, you allow the administration of the estate process to be far quicker and more affordable for your family after you’re gone. Think of the price of your car, home, breakdown, or holiday insurance policies that only cover specific things. Compare this to a Will and trust that covers everything that you own.

“I’m too young to make a Will.”

Reality:

It’s easy to think that creating a Will is something you only need to worry about when you’re older. But the truth is, life is unpredictable! Accidents, unexpected events, and even pandemics can happen at any age. Whether you have a lot of assets or just a few specific wishes, it’s worth considering making a Will, no matter how young you are.

Two of my sons are in their Twenties; both have Wills. One was because he travelled around Australia and Asia for six months, and the other was after a near miss on the building site.

“I’ve verbally told my wishes, so a Will isn’t necessary.”

Reality:

Instructions may hold little legal weight. However, creating a Will ensures that your wishes are formally documented and legally enforceable. Whether you want to exclude specific family members from your estate or provide specific instructions for your children's care, a Will is essential for making these intentions legally valid."

“Once I make a Will, I can’t change it.”

Reality:

The Society Of Will Writers advises that you review your will every three to five years to consider any changes in circumstances. It’s a flexible document that should evolve with your life.

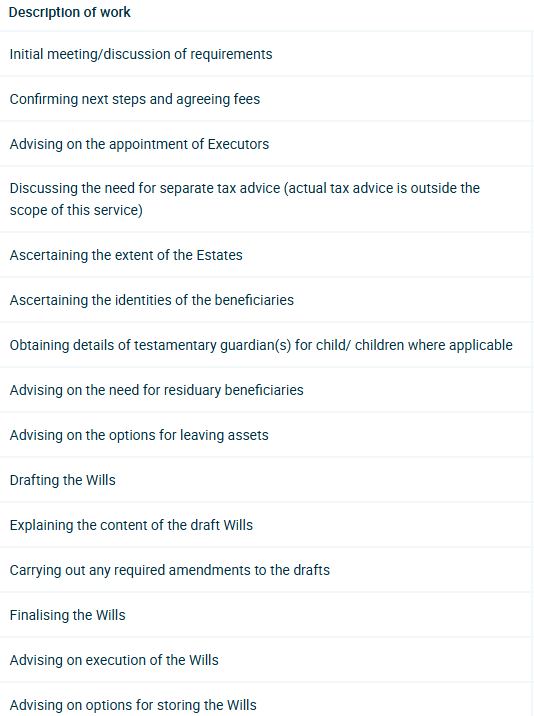

“It is hard to know the scope of what is provided.”

Below is a summary of the standard items of work that are included in the service offered: